How To Set Up Strive Score On Peloton

How to Fix Yourself Up for a Perfect Credit Score

Follow communication from people who have infrequent scores.

When my husband and I practical for a home equity line of credit recently, the bank checked our credit scores. Lenders typically do this to determine how much of a credit risk you are, how much they're willing to lend you and what interest rate yous'll pay. Every bit we were signing our closing papers, the loan officeholder commented that I had the highest credit score she had always seen. It was 833. That'southward just 17 points shy of a perfect 850 credit score — a humble brag, I know.

Honestly, though, my high-credit money personality doesn't brand me an anomaly. Near 21 percent of U.S. consumers have a FICO credit score of 800 to 850 — which is considered exceptional, according to FICO. And so it's non impossible to have a score in a higher place 800, or even a perfect 850.

Go advice from people who accept perfect — or about-perfect — scores to find out how you tin can too.

Click through to find out how to go the highest credit score possible.

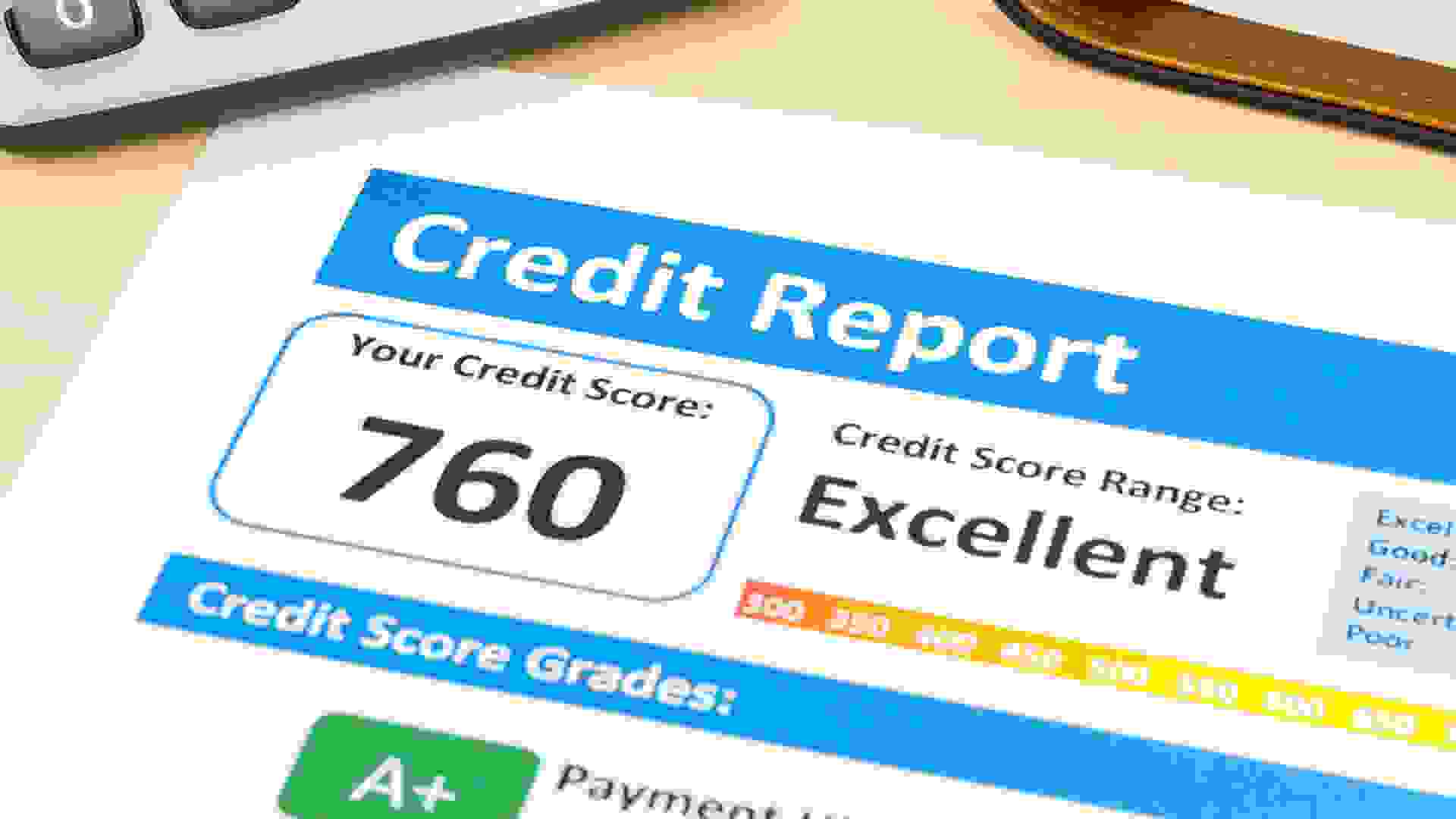

Understand the Credit Score Range

The FICO credit score — the score most unremarkably used past lenders — ranges from 300 to 850. Some manufacture-specific FICO scores range from 250 to 900. The boilerplate FICO credit score is 700, according to FICO. That is considered a good credit score, simply you'll get the all-time deals from lenders if your score is 760 or higher, said credit skillful John Ulzheimer, formerly of FICO.

VantageScore is another credit scoring model created by the three credit bureaus: Equifax, Experian and TransUnion. The latest version of the VantageScore as well ranges from 300 to 850.

Know What Affects Your Credit Score

Knowing what goes into your credit score will help you understand why y'all have the score you exercise and what you can do to improve your credit score. The commonly used FICO score is calculated using v factors: payment history, length of credit history, amounts owed, new credit and credit mix.

These factors aren't weighted equally, though. Payment history and amounts owed are the most important factors and contribute to 35 percent and 30 percent, respectively, of a credit score. Length of credit history — that is, how long y'all've had credit — accounts for 15 percent of your score. New credit, or accounts that have been opened recently, makes upwardly x percent. Your mix of credit cards, retail accounts, installment loans and mortgage loans makes up the remaining ten per centum.

Check Your Credit Regularly

People with a perfect credit score or nearly perfect score check their credit regularly. Your credit written report — which you tin can become for free at AnnualCreditReport.com — shows where y'all stand when it comes to the factors used for computing your credit score.

If you come across your score dip, checking your credit report can aid you lot determine what inverse, said Neal Frankle, a financial planner and founder of credit repair site Credit Pilgrim. "If you encounter it ascent, practise more of what was behind that ascent," he said.

Checking your report often also can help y'all find mistakes on your credit report that are hurting your score. "Unfortunately, it's upwards to you to grab those errors and correct them," Frankle said. Contact the credit bureaus and your creditors to dispute whatever mistakes you find and have them removed from your report.

Find Out: How to Bank check Your Credit Score

Ever Make Payments on Fourth dimension

Considering that your payment history accounts for 35 percent of your credit score, making late payments can keep you out of the perfect score gild. Louis DeNicola, a freelance author specializing in personal finance and credit, said his VantageScore is above 800 and his FICO score is nearly 800 because he'southward never had a late payment.

"From the beginning, I treated credit cards like debit cards and merely purchased what I could beget to pay off," DeNicola said. "Since I know I have plenty money to cover what I buy, I've turned on autopay for all my credit cards to ensure I don't accidentally miss a payment."

Brand Payments Before They're Due

To increase your chances of getting a perfect credit score, don't wait until payments are due. Amy Rutherford and husband Tim, founders of the blog Go With Less, discovered that paying off credit bill of fare balances before the payment due date additional their credit scores.

"We take learned that our credit score will become down as much as 30 points instantly if we charge as well much on a specific carte du jour inside a billing cycle," Amy Rutherford said. "We will pay a balance on a credit bill of fare before the due date to get this back in residual."

Click here to learn how it's possible to accept a perfect payment history and bad credit.

Keep Your Credit Utilization Very Low

Having a lot of credit cards or lines of credit won't necessarily hurt you if you keep your credit utilization ratio low. That's the technical term for the percentage of bachelor credit that y'all are using.

"We keep our scores high by keeping our utilization extremely low," said Holly Johnson, who has a credit score of 825 and created the blog Social club Thrifty with her husband, Greg. "Even though our credit cards may occasionally have balances, we always pay them off earlier the due date and remain 100 percentage debt-gratuitous."

The key is to proceed your credit utilization at ten percentage of your bachelor credit or lower, said Lotasha Thomas, a financial educator and CEO of My Finances Matter. Doing that was one of the things that helped Thomas boost her credit score to 810 from 465.

Up Next: Who Looks at Credit Scores?

Build a Long Credit History

You can command whether you make payments on time and how much you owe. Just to go a perfect credit score, you too demand to have a long credit history. "Y'all can't control how old yous are, so that'southward where many people miss out on points," Ulzheimer said. "You really need to accept a credit written report that's well over xx years old."

Typically, that takes fourth dimension. But DeNicola establish a way around that obstacle to a high score. His mom added him as an authorized user on her credit card when he was younger. "So, in spite only beingness 29 years old, my oldest business relationship is over 22 years old," DeNicola said. That account has helped increase the average age of his accounts and gave him a longer credit history.

Click here to detect out how to enhance your credit score past 100 points.

Don't Open Lots of New Accounts at Once

DeNicola's score would exist even college if he hadn't opened several credit cards in recent years. This brought down the average historic period of his accounts. Opening several accounts at once tin can have a bigger impact on the credit scores of people who don't have a long credit history considering information technology will lower their average account historic period, according to myFICO.

To get a perfect score, "don't endeavour to obtain a lot of credit in a short period of time," Thomas said. Her score has benefited considering she rarely applies for new credit.

Click here to find 30 things that could mess up your credit score.

Don't Close Old Accounts

Some people wrongly assume that a credit report with fewer accounts will score meliorate than a credit report with more lines of credit, Ulzheimer said. They shut accounts they don't regularly use or effort to go old, airtight accounts removed from their credit reports.

"This will lessen the boilerplate age of your accounts and can cause your scores to go downward," Ulzheimer said. Plus, closing credit bill of fare accounts volition reduce the amount of available credit you have. Every bit a result, your credit utilization ratio could rise and your credit score could drop.

Have a Skillful Mix of Credit

Ulzheimer said that both the FICO and VantageScore systems consider the types of accounts actualization on your credit reports — that is, whether you lot have a mix of credit cards, retail accounts, installment loans and mortgage loans. "Information technology'south a very small contributor to your score," he said. "Simply if you want 850, you've got to pay attention to everything, including the minor stuff."

That doesn't mean you should run out and open several new accounts at once. But you should be enlightened that having fewer types of accounts can forbid you lot from getting a perfect score. Rutherford said her score isn't perfect because she and her hubby paid off their mortgage and car loans. Credit cards are their just lines of credit, and then her credit mix is lacking.

Is It Worth It to Pursue a Perfect Score?

You lot don't accept to have a perfect credit score to get the best credit terms. Both Frankle and Ulzheimer said a score of 760 or higher will help you authorize for the all-time credit offers. "If yous want to be a perfectionist, shoot for 800," Frankle said. "But anything higher up that is overkill."

You don't necessarily have to go out of your way to go an infrequent score. "If yous manage your credit responsibility — every bit in maintaining low debt and never missing payments — and so your scores actually accept no choice but to exist slap-up," Ulzheimer said. "And as your credit reports age, you lot'll gain those points organically."

That'south pretty much the strategy I've used, and it's worked for me.

More on Perfect Credit Scores

- Your Credit Score Could Be Getting a Heave — Here's Why

- 30 Things You lot Need to Know to Build Credit

- 10 Things to Exercise Now If You Have a 700 Credit Score

Kailiokalani Davison contributed to the reporting of this commodity.

Virtually the Author

Source: https://www.gobankingrates.com/credit/credit-score/how-to-get-perfect-credit-score/

0 Response to "How To Set Up Strive Score On Peloton"

Post a Comment